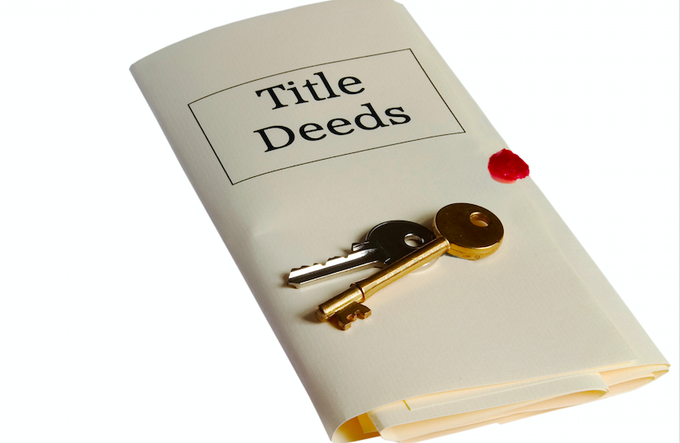

Investing in real estate is an exciting venture that can bring both financial stability and a sense of pride. However, before you sign on the dotted line and hand over your hard-earned money, it's crucial to conduct a property title search. In this article, we'll delve into the significance of performing a property title search before purchasing a property and highlight the potential risks you can avoid. Let's embark on this enlightening journey together!

What is a Property Title Search?

Imagine purchasing a property only to discover later that it has multiple liens, unresolved legal disputes, or even worse, that it doesn't legally belong to the person selling it. A property title search is like a Sherlock Holmes investigation that uncovers the hidden secrets and potential pitfalls lurking within the property's history. It involves thoroughly examining public records, court documents, and other relevant sources to ascertain the ownership, legal status, and any encumbrances associated with the property.

Uncovering Hidden Issues

When conducting a property title search, you're essentially donning a detective's hat. Your mission is to uncover any hidden issues that may cloud the property's ownership or pose a risk to your investment. Here are a few key areas where a title search can save you from potential headaches:

1. Ownership Verification:

By examining historical records, you can confirm that the person selling the property is indeed the legal owner. This step ensures that you are dealing with the rightful owner and not someone trying to pull off a scam.

2. Liens and Encumbrances:

A property may have outstanding debts or liens attached to it, such as unpaid taxes, mortgages, or construction loans. These encumbrances can become your responsibility once you become the owner, potentially leading to legal battles or financial burdens.

3. Easements and Restrictions:

A title search reveals any easements or restrictions that affect the property's usage. For instance, there may be a right-of-way that allows others to access your land, or there might be limitations on building structures.

4. Legal Disputes:

Sometimes, properties become entangled in legal disputes, such as boundary disagreements, divorce settlements, or inheritance battles. By conducting a title search, you can identify any ongoing litigation that may impact the property's ownership or value.

Protecting Your Investment

Now that you understand the potential risks associated with purchasing a property without a title search, it's time to highlight how this essential step can protect your investment. Here's why you should never skip a property title search:

1. Peace of Mind:

Knowing that you have thoroughly researched the property's title provides peace of mind. It allows you to enter the transaction with confidence, knowing that you are making an informed decision based on accurate information.

2. Avoiding Financial Loss:

Imagine buying a property and then discovering that it has a hefty tax lien or a pending lawsuit against it. By conducting a title search, you can identify these issues beforehand and either negotiate a better deal or steer clear of a potential financial disaster.

3. Ensuring a Clean Transfer of Ownership:

A property title search ensures that the transfer of ownership occurs smoothly and legally. It helps prevent any legal disputes or challenges in the future, as you will have evidence of a clean title.

4. Facilitating Future Sales:

If you decide to sell the property down the line, having a clear and marketable title will make the process much easier. Prospective buyers will feel more confident knowing that you have done your due diligence and can provide them with a secure investment.

Conclusion

Getting a property title search before purchasing a property is not just a recommended step; it is an absolute necessity. It acts as your shield against potential legal, financial, and emotional repercussions. By delving into the property's history and uncovering any hidden issues, you can make an informed decision and protect your investment.

Real estate transactions involve substantial amounts of money and long-term commitments. Skipping a property title search is like taking a blind leap into the unknown. It's like buying a car without checking its history or adopting a pet without knowing its medical background. The consequences can be devastating and can haunt you for years to come.

Remember, before you get caught up in the excitement of finding your dream property, take a moment to prioritize due diligence. The dedicated staff at Title Search Direct is always available to help you get started. A quick Google search can get you in contact with any of our nationwide offices; for example, if you happen to be in New Jersey, just type "title search New Jersey" into Google and you should see Title Search Direct for that location. Our trained experts can conduct a comprehensive property title search and ensure that no stone is left unturned and that you have a clear understanding of what you're getting into.

In conclusion, the importance of a property title search cannot be emphasized enough. It is your safeguard against unforeseen complications and a vital step in securing your investment. Don't let the allure of a property blind you to the potential risks that lie beneath the surface. Take the time to investigate, verify, and validate the property's title. By doing so, you'll set the foundation for a smooth and secure real estate journey. Happy property hunting!